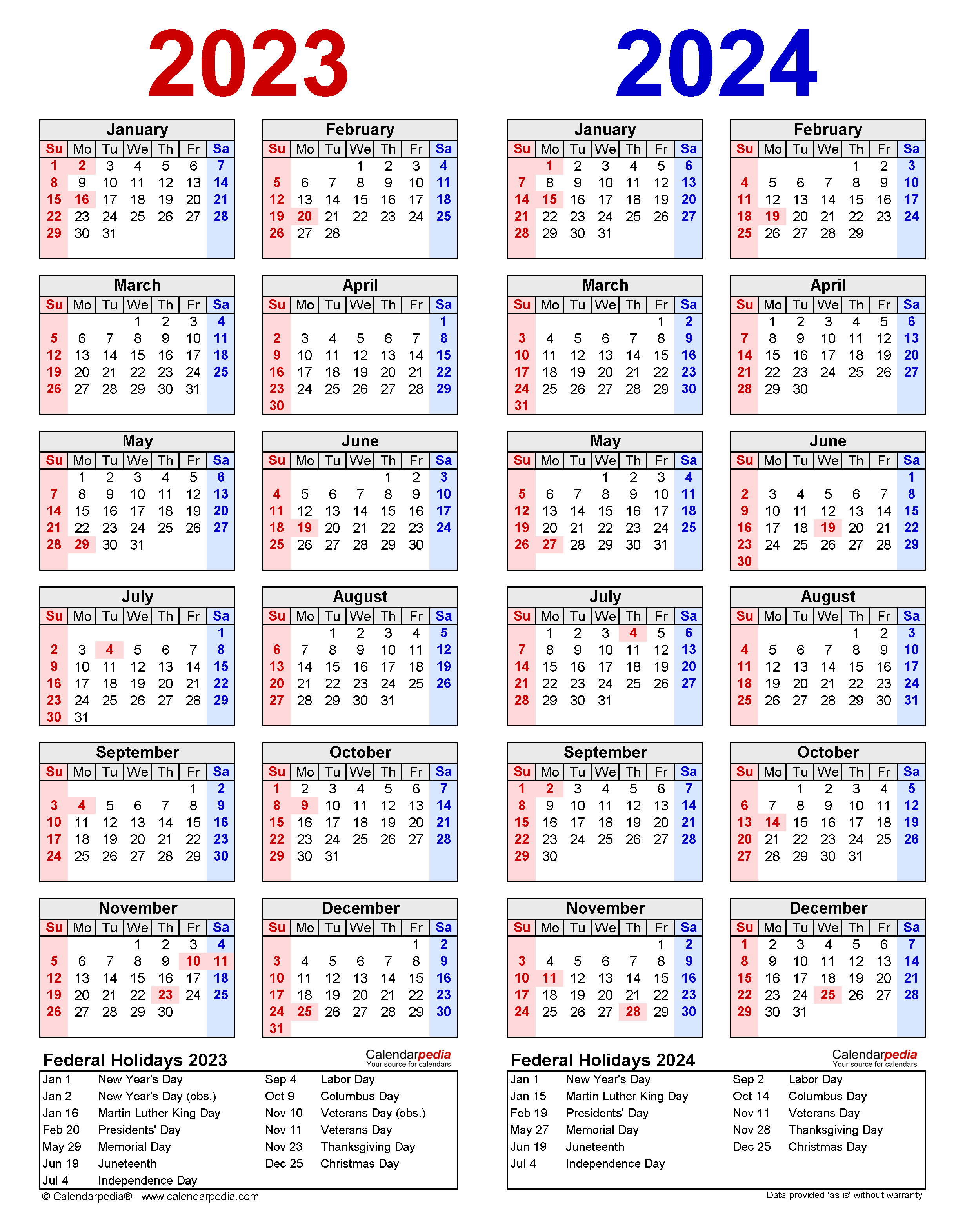

Calendar Year Schedule A Form 1040 2024

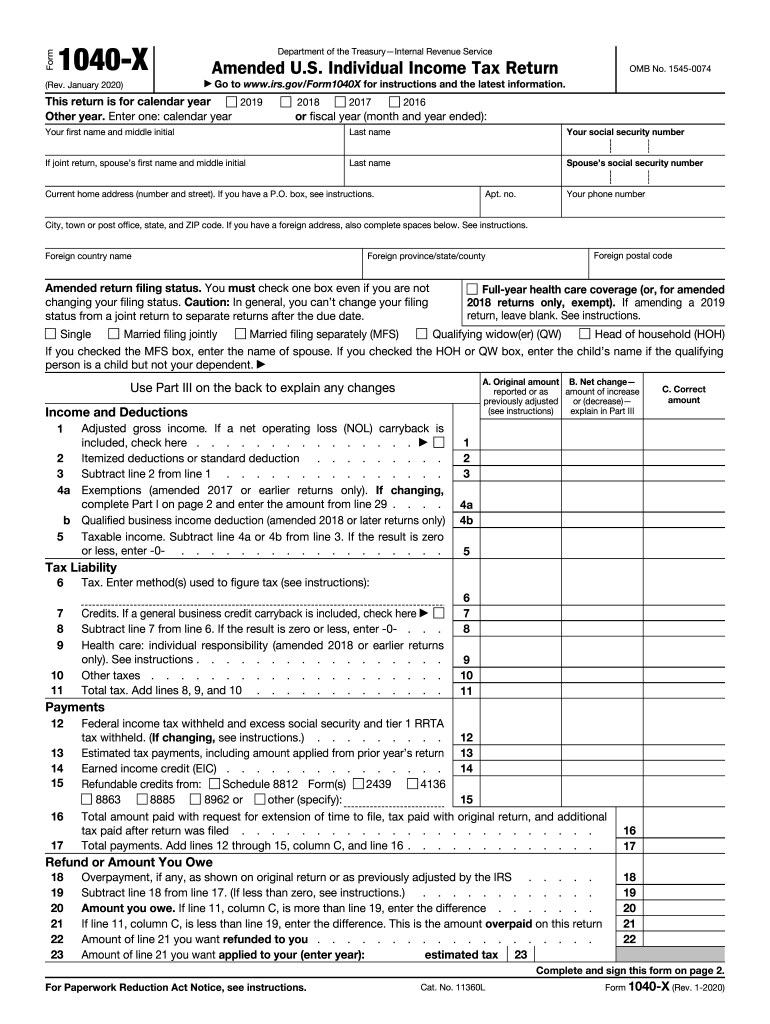

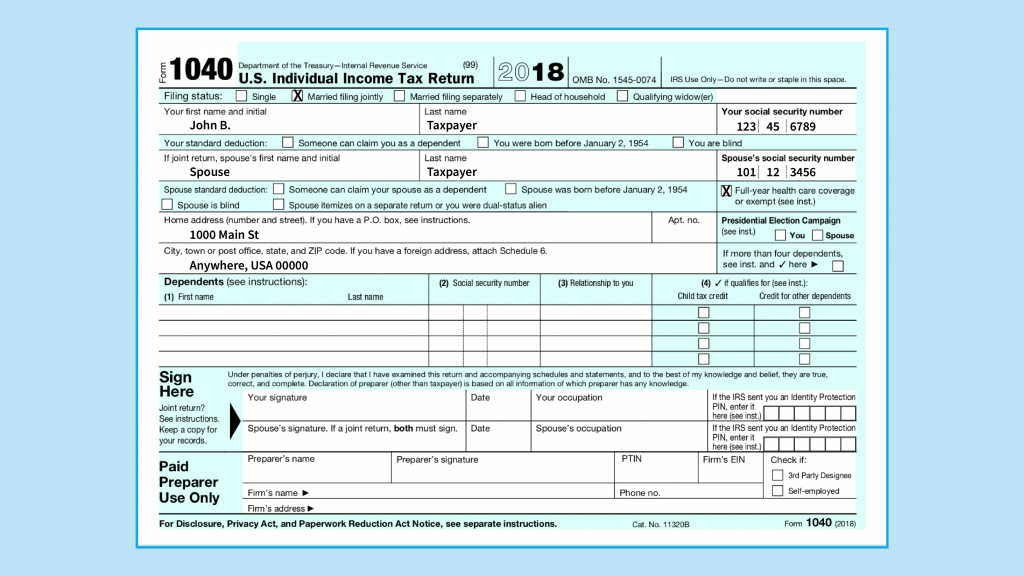

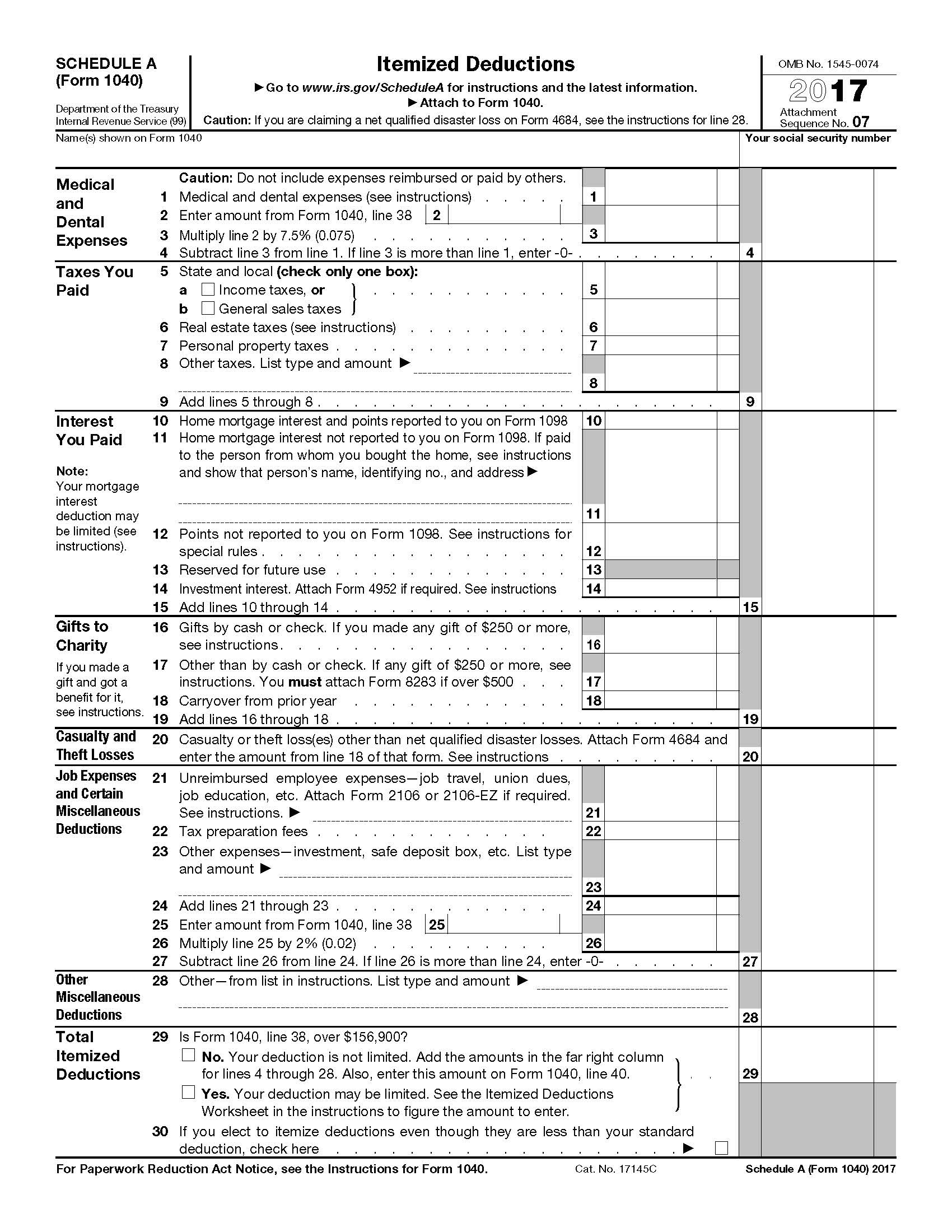

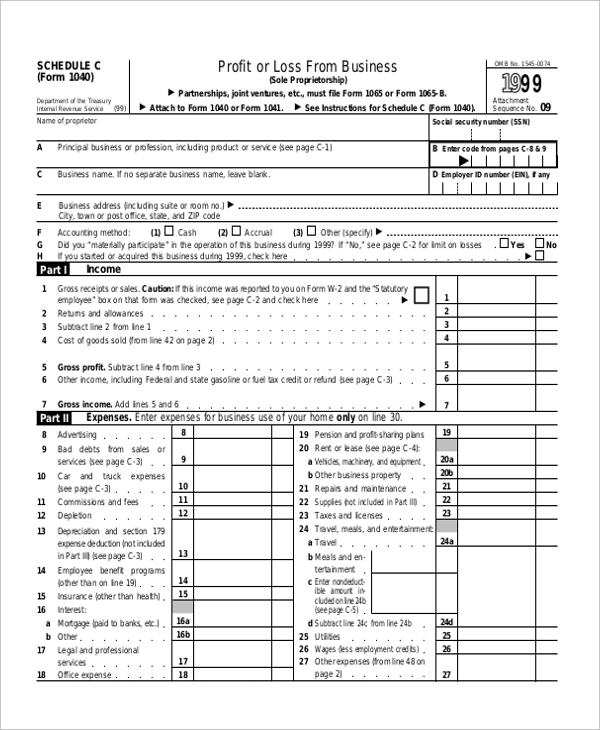

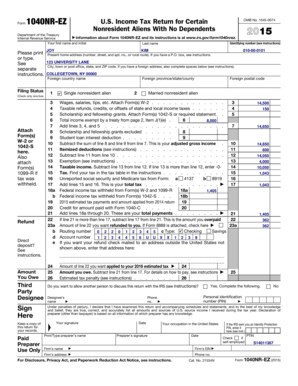

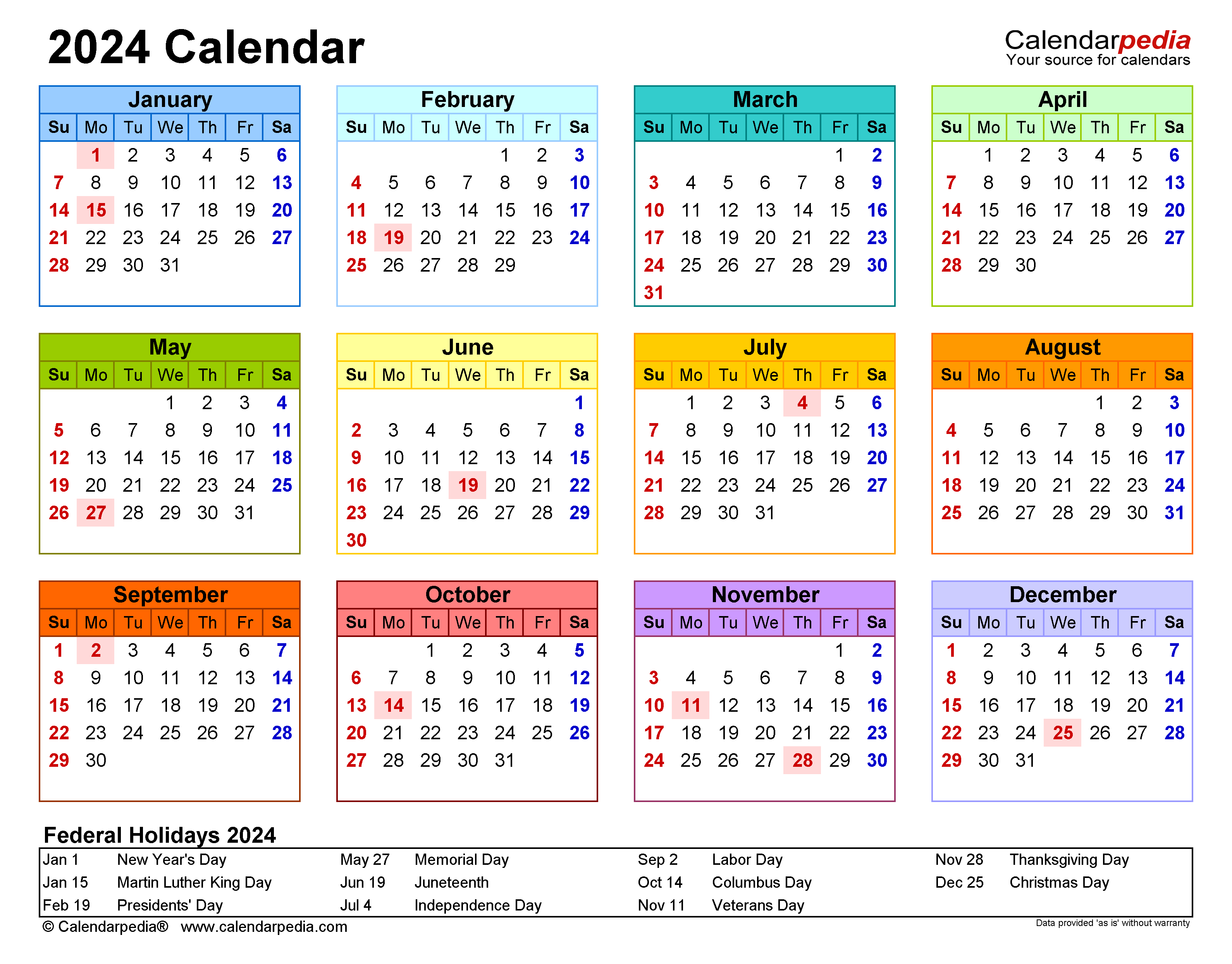

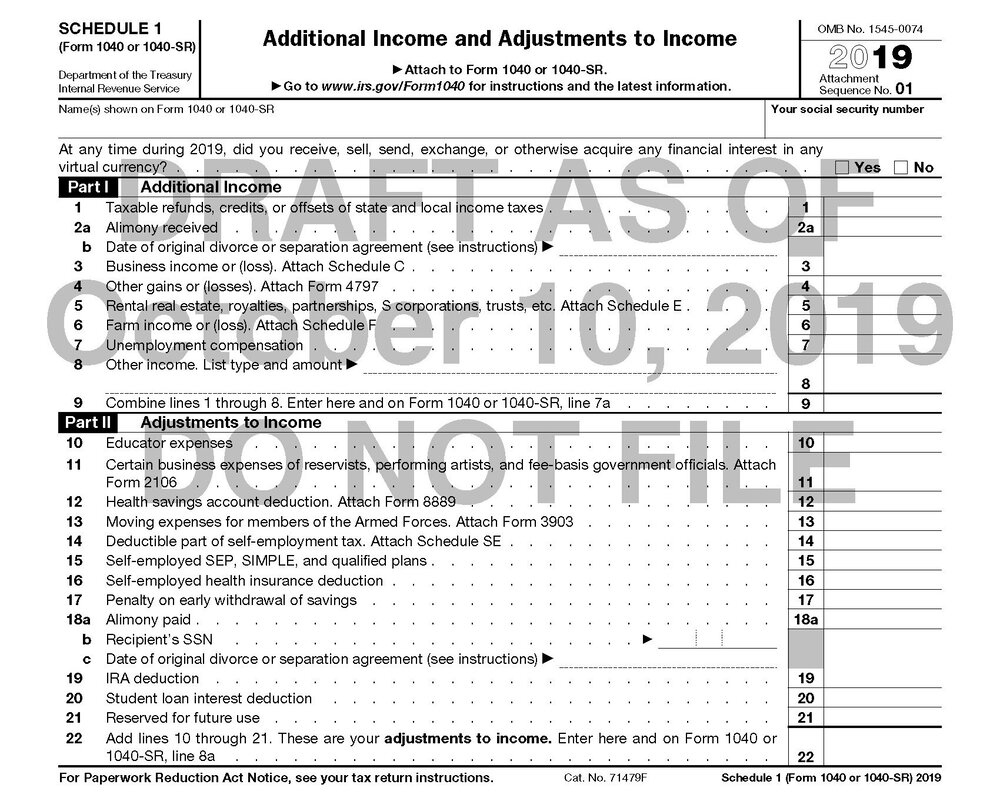

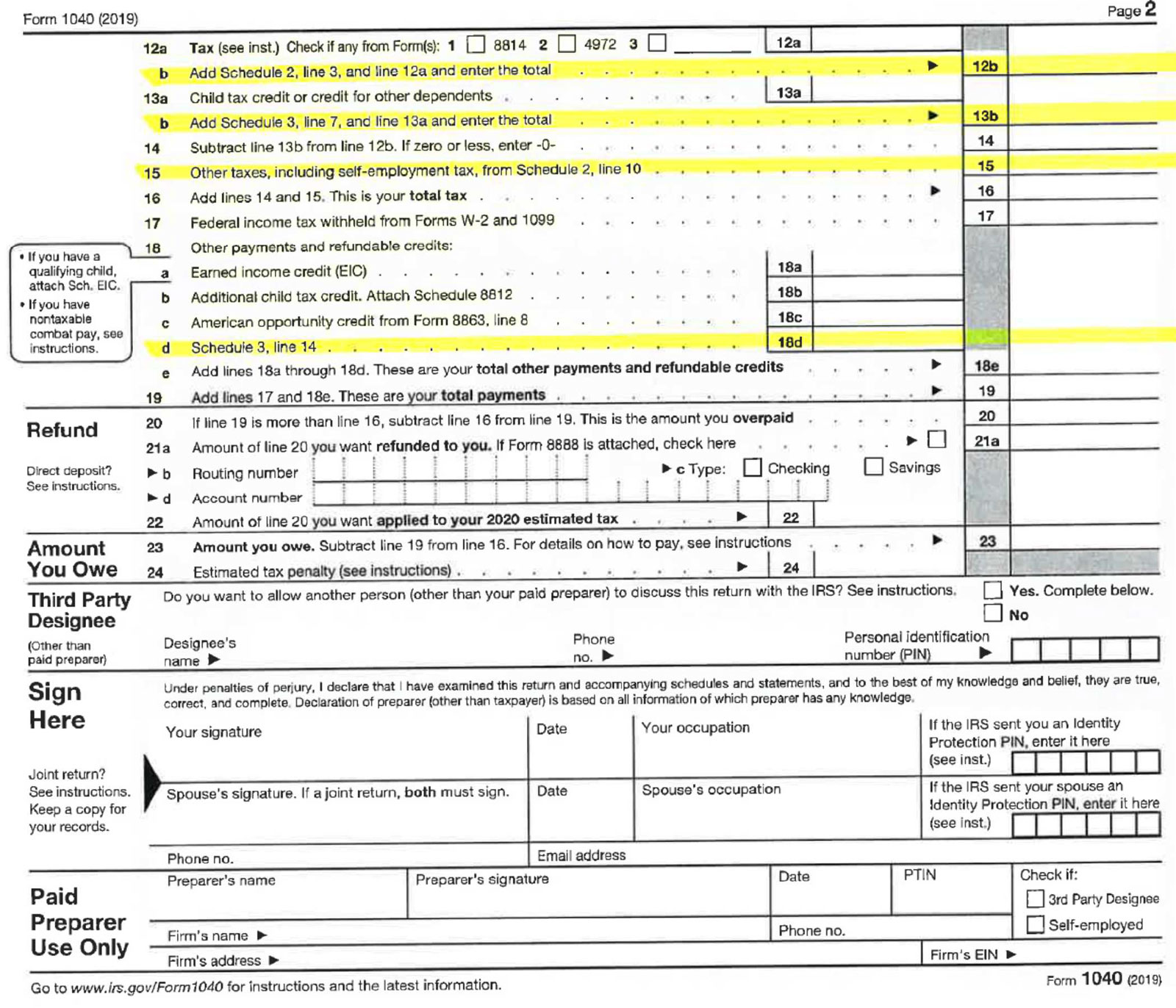

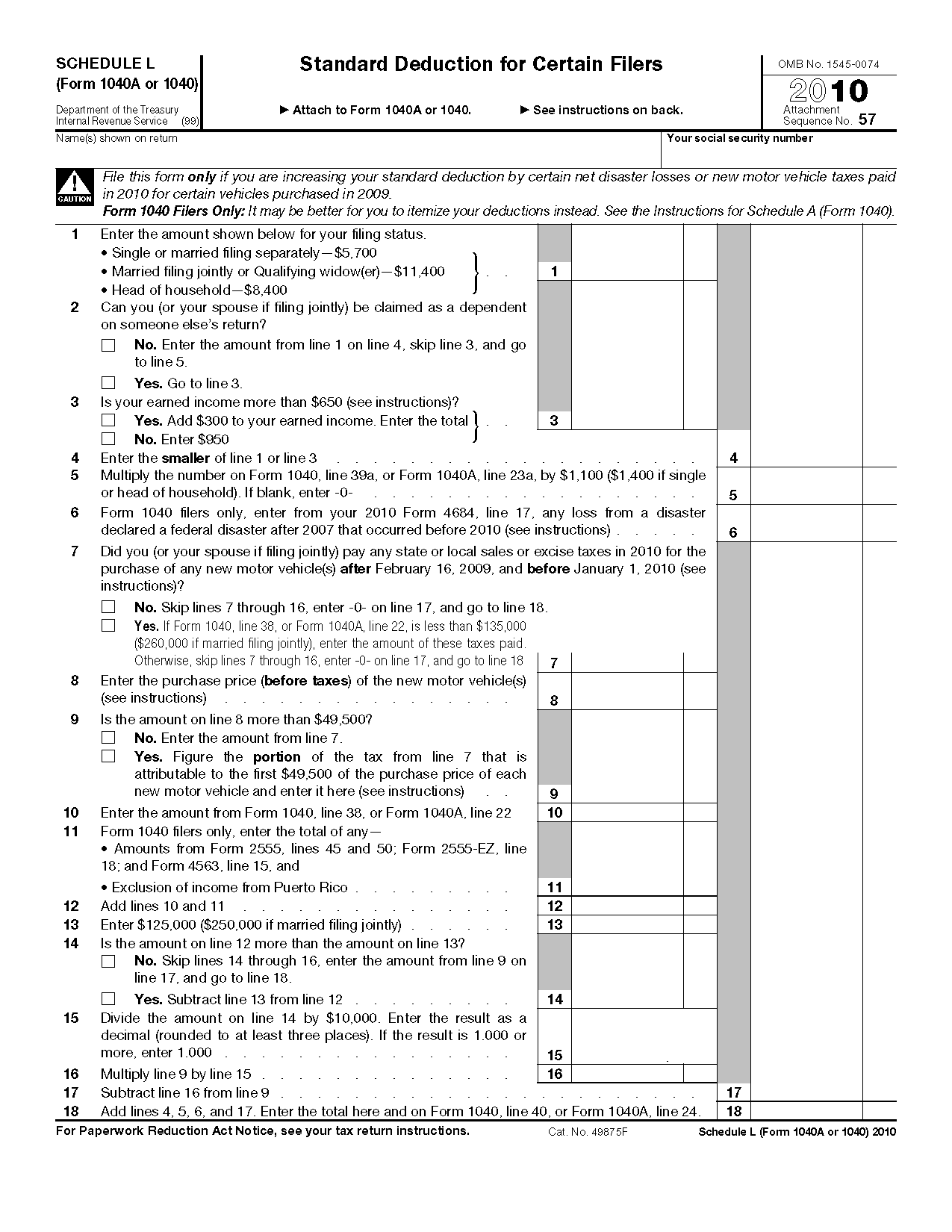

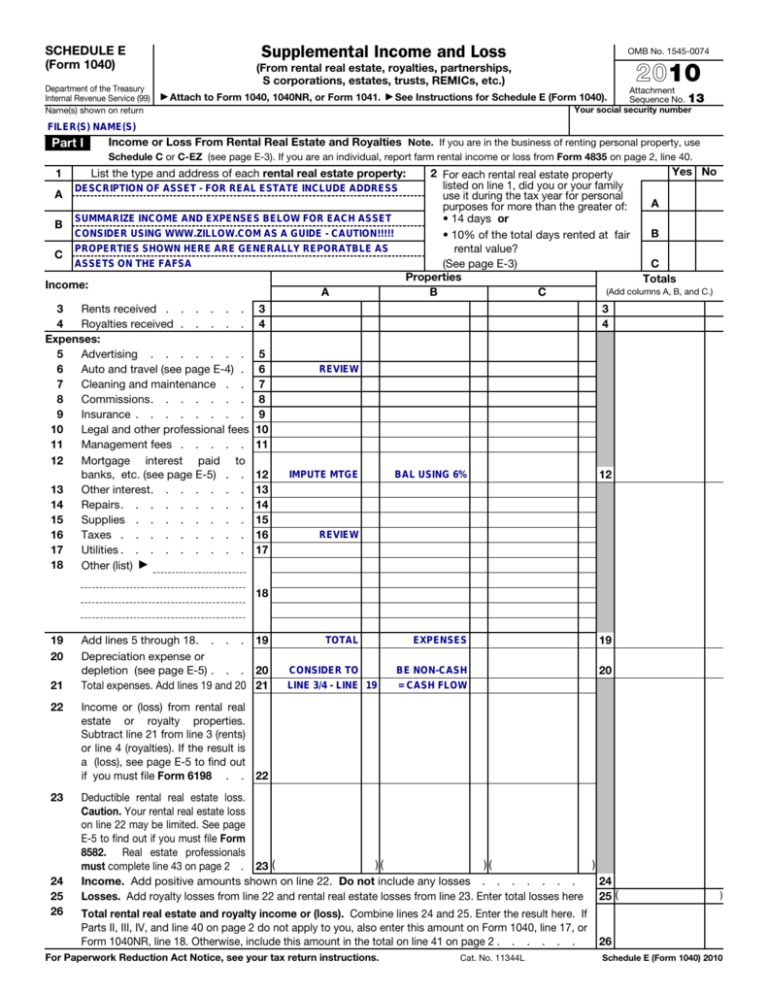

Calendar Year Schedule A Form 1040 2024. Schedule A is required in any year you choose to itemize your deductions. Online Tax Calendar View due dates and actions for each month. You can see all events or filter them by monthly depositor, semiweekly depositor, excise, or general event types. Caution: Do not include expenses reimbursed or paid by. Generally, most individuals are calendar year filers. If more than two-thirds of your income is from farming. Visit this page on your Smartphone or tablet, so you can view the Online Tax Calendar on your mobile device. C., holidays impact tax deadlines for everyone in the same way federal holidays do.

Calendar Year Schedule A Form 1040 2024. That will allow your eyes to adjust to the dark. If your due date falls on a Saturday, Sunday, or legal holiday, the due date is moved to the next business day. US companies could pull back on hiring or cut headcount to deal with higher debt payments, Goldman Sachs said. You can see all events or filter them by monthly depositor, semiweekly depositor, excise, or general event types. Then, the form guides you through a number of calculations related to deductions and. Calendar Year Schedule A Form 1040 2024.

That will allow your eyes to adjust to the dark.

Then lie back and take in a large swath of the.

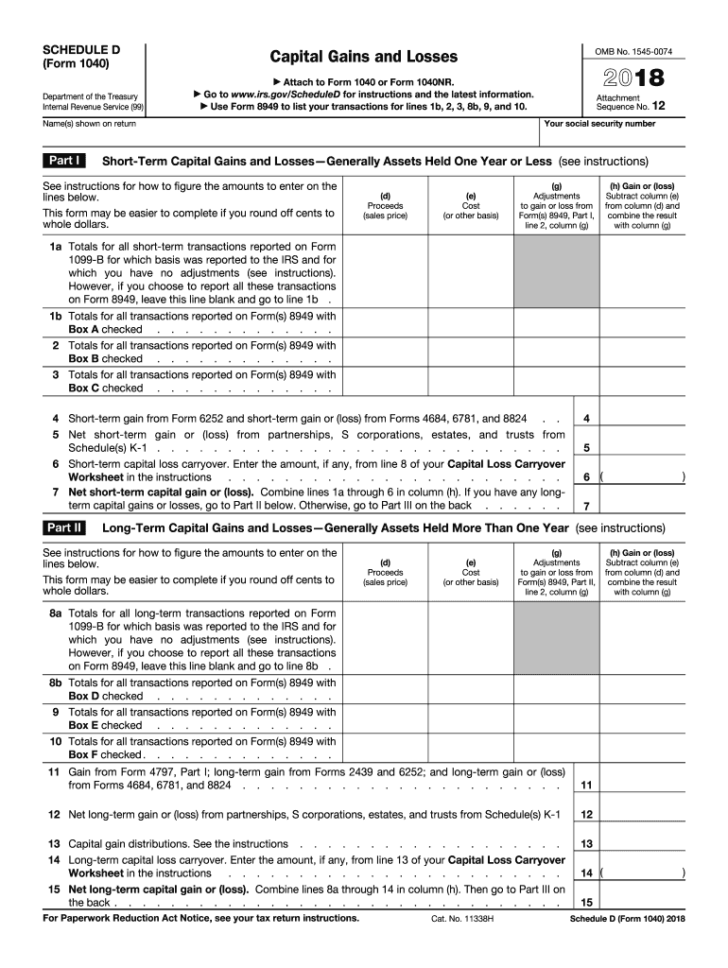

Calendar Year Schedule A Form 1040 2024. C., holidays impact tax deadlines for everyone in the same way federal holidays do. Caution: Do not include expenses reimbursed or paid by. If Tax Day falls on a Saturday, Sunday or holiday the deadline to file taxes. The schedule has seven categories of expenses: medical and dental expenses, taxes, interest, gifts to charity, casualty and theft losses, job expenses and certain miscellaneous expenses. If more than two-thirds of your income is from farming.

Calendar Year Schedule A Form 1040 2024.