Calendar Call Spread 2024

Calendar Call Spread 2024. Download a calendar template: Browse through the calendar templates, choose an Excel calendar template that is best for you. The Options Strategies » Long Calendar Spread w/Calls. A short calendar spread with calls is created by selling one "longer-term" call and buying one "shorter-term" call with the same strike price. A long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having. There are two types of long calendar spreads: call and put. Click the Download button on the template page, open the template file in Excel, and then edit and save your calendar. That's because the back-month call is still open when the front-month call expires. The year-at-a-glance template has an area for planning and activities and organizes the months in a vertical pattern.

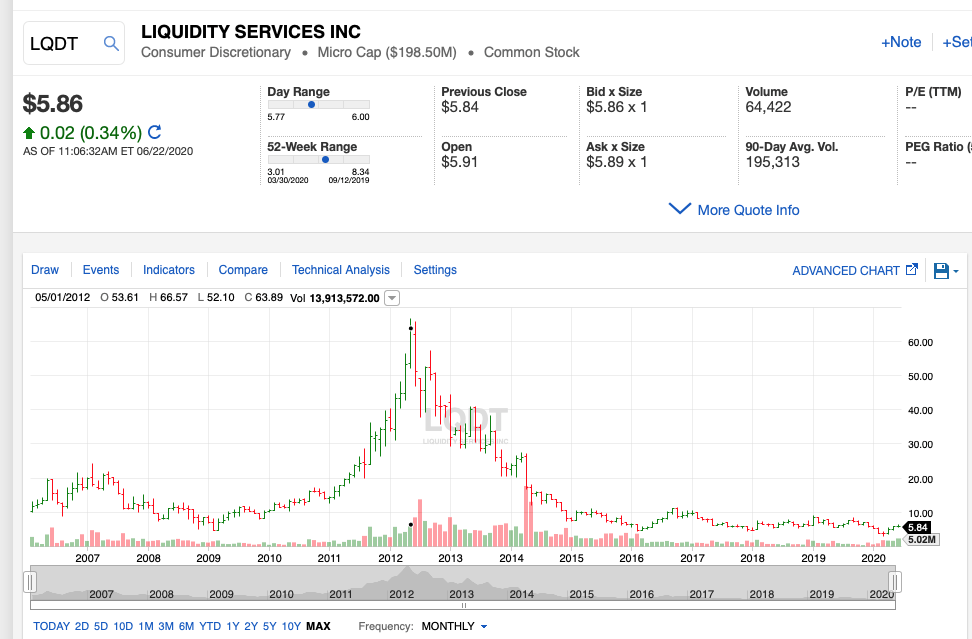

Calendar Call Spread 2024. Palo Alto typically reports on a Monday or Tuesday during the fourth week of the month. It should proportionally resize the document to fit. The first is to buy and sell options of different expiration months, but at the same strike price (horizontal. You can also create the calendar call spread as a diagonal spread, by buying calls with a lower strike than the calls you write. The only thing that separates them is their expiry date. Calendar Call Spread 2024.

It should proportionally resize the document to fit.

There are two types of long calendar spreads: call and put.

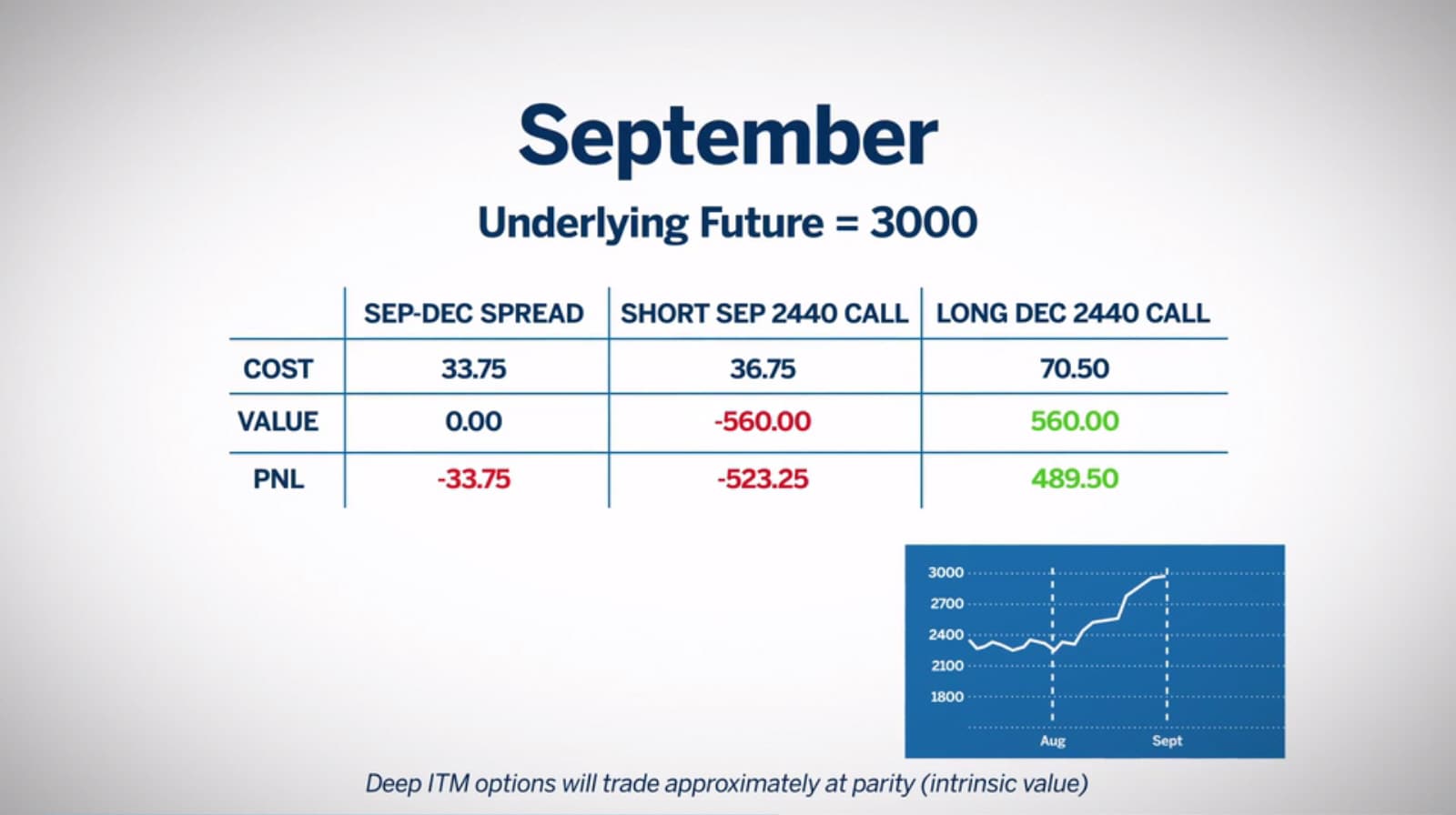

Calendar Call Spread 2024. In such case, look for a "Fit to page" or "Reduce/Enlarge" option in your printer's preferences dialog. NOTE: The profit and loss lines are not straight. The first is to buy and sell options of different expiration months, but at the same strike price (horizontal. Covered Calls and Calendar Spreads – Definitions. Short Call Calendar Spread (Short Call Time Spread) This strategy profits from the different characteristics of near and longer-term call options.

Calendar Call Spread 2024.